Corporate Governance

Basic Approach to Corporate Governance

Our origins are the materials / processing / surface treatment technology and other monozukuri that we have cultivated since our establishment in 1939, and we operate our business aiming for our Corporate Philosophy of "realizing a clean, high quality global society".

To realize this, we build good relationships not only with shareholders and customers, but also suppliers, regional societies, employees and other stakeholders, and we believe it is important to aim for continued growth through unmatched technology and providing valuable products, and we fully engage with Corporate Governance.

Basic Policy

Based on the basic policy below, we work to improve the effectiveness of Corporate Governance.

- We respect shareholders' rights and assure equality.

- We collaborate appropriately with everyone, including shareholders, employees, suppliers and regional societies.

- We make appropriate Company Information disclosures and assure transparency.

- Board Members and Auditors recognize their fiduciary responsibility and explanation responsibility, and appropriately fulfil their required role/responsibility.

- We work on constructive dialogue with shareholders.

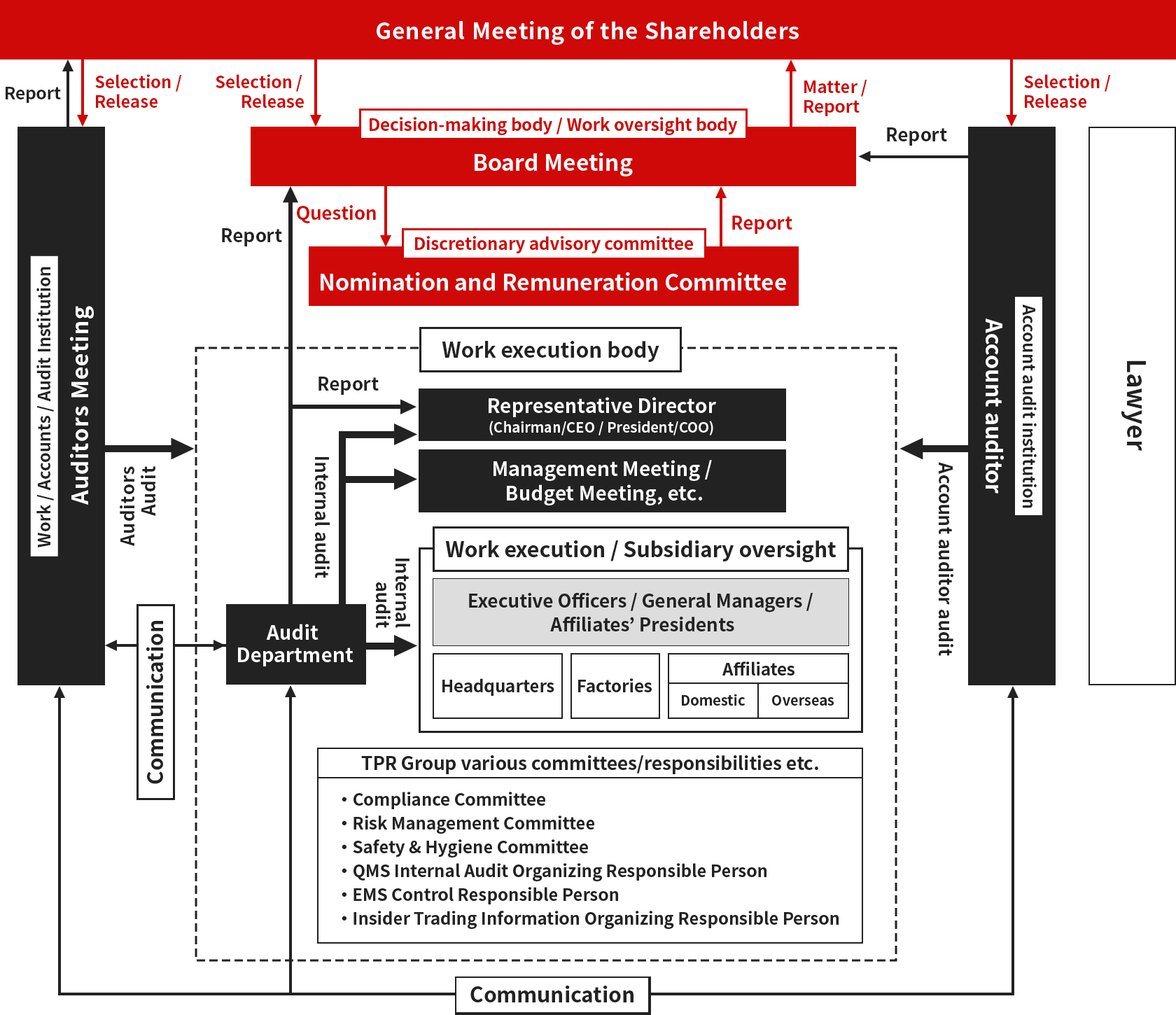

Outline of Corporate Governance structure

- Our company has a Board Meeting and Auditors Meeting.

- To separate the oversight function and work execution of Board Members, we have introduced an executive officer scheme, starting with the Chairman and CEO and President and COO.

- The Auditor Meeting will communicate with the Internal Audit Division, and regularly exchange opinions with the accounts auditors, and will promote full Corporate Governance by conducting appropriate and proper audits.

Board Meeting

Structure

Made up of 8 Board Members, to ensure our company's Corporate Governance, starting with internal compliance enhancement and realizing compliance adherence, 3 independent external Board Members (from the finance industry, from the manufacturing industry, a lawyer) are appointed.

Frequency of meetings

As a rule, the Board Meeting will be held every month, but also on an ad hoc basis as required, and as well as debating/deciding critical items of management, will oversee work execution.

Management Meeting

With the aim of making the discussion at the Board Meeting efficient and vigorous, as a rule the Management Meeting, formed of Executive Officers who are Managing Executive Officers and above, discusses critical matters and puts only the agreed items to the Board Meeting. The Management Meeting is held regularly twice per month, but also on an ad hoc basis as required.

Nomination and Remuneration Committee

To enhance the transparency and objectivity of the nomination / remuneration of senior executives, the Nomination and Remuneration Committee is established as an advisory function to the Board Meeting. The Committee is formed of 3 or more members, with the majority being independent external Board Members.

The main items for consideration at the Nomination and Remuneration Committee are "items relating to the nomination and release of Board Members / Auditors", "items relating to the selection and release of the CEO, COO", "items relating to the policy for formulating the remuneration of Board Members, Auditors", etc.

Auditors Meeting

Company with Auditors

We are a company with Auditors, and as well as following the audit policy and division of work that forms each Auditor's audit scope as defined at the Auditor Meeting for the work to be undertaken by Board Members, if any Board Member discovers that another Board Member has violated code or the articles of association, that should be immediately reported to the Auditors and Board Meeting, with the aim of correcting that.

Structure

There are 5 Auditors, of which 3 are highly independent external Auditors who have specialist knowledge, to assure a neutral and objective audit structure. Auditors conduct audits in line with the audit policy and division of work defined at the Auditors Meeting.

Audit Department

The Audit Department is established as the Internal Audit Division which is a direct report to the President, conducting audits relating to work execution. The Audit Department will hold regular meetings with Auditors to exchange opinions and communicate. Also, to support the work of the Auditors, Auditor staff members (concurrent with other roles) will be in place.

Scroll sideways

Outline of Corporate Governance structure

Scroll sideways

| Organization form | company with auditors |

|---|---|

| Board Members | 8 (of which, 3 are external Board Members) |

| Board Member term of office | 1 year |

| Number of Auditors | 5 (of which, 3 are external Auditors) |

| Number of Independent Officers | 3 internal Board Members, 3 external Auditors |

| Number of Board Meetings held | 17 (FY2021) Attendance: 100% (of which, 1 external Board Member after appointment in June, attended all 14 occasions) |

| Number of Auditor Meetings held | 17 (FY2021) Attendance: 100% |

| Number of Nomination and Remuneration Committee meetings held | 4 (FY2021)(of which, 1 external Board Member after appointment in June, attended all 2 occasions) |

Board Member Remuneration, etc.

Basic Policy

Our company's Board Member remuneration should function as sufficient incentive for continued improvement of corporate value, and should therefore link to company performance and medium to long term corporate value, and for decisions about individual Board Members' remuneration, our basic policy is that this should be at an appropriate level taking each's role and responsibility and results into account.

Specific work execution Board Member's remuneration is made up of management remuneration and variable remuneration, and shares remuneration through a Board Member Shareholding Remuneration Scheme (shares benefits) as an incentive to be aware of corporate value improvement.

Also, the remuneration of Board Members who do not concurrently execute work will be management remuneration and shares remuneration, and Auditors' remuneration will only be management remuneration.

- With the 88th regular General Meeting of the Shareholders held on June 29th, 2021, our company abolished the retirement recognition monies scheme.

Board Members' Remuneration

(1) Management remuneration (monetary remuneration)

Management remuneration is a monthly fixed remuneration, and is an overall decision that takes into consideration the standard at other companies for the position, role and responsibility, our company's performance, and the standard of employee salaries.

(2) Variable remuneration (monetary remuneration)

Variable remuneration is to heighten the incentive for performance improvement for each business year, and is a calculated contribution amount based on the management environment, prior business year company performance and individual performance of the work execution Board Member, divided equally into 12 parts and added and paid with the management remuneration.

The company performance and indicators that become the target are set when the plan is formulated in line with the management environment for the consolidated ordinary profit based on the Mid Term Management Plan and the indicators appropriate for the role and responsibility of each work executing Board Member, and changes in environment will be reviewed through the reports of the Nomination and Remuneration Committee whose majority is made up of independent external Board Members.

Board Members who do not concurrently execute work and Auditors are not paid variable remuneration.

(3) Shares remuneration (non-monetary remuneration, etc.)

Non-monetary remuneration etc. is a remuneration scheme to assure a link to medium to long term corporate value improvement, and is a shares remuneration through a shareholding benefit, and are paid based on the "Board Member Shareholding Benefit Rules".

Specifically, this is a points scheme based on position, and points are granted at a certain point in time every year. The timing is when the Board Member is released, and as a rule for every 1 point gained during the term, this is converted into 1 share. Also, if there is certain Board Member wrongdoing or inappropriate action, the relevant Board Member does not have the right to receive our company's shares, etc.

Auditors are outside the scope of shares remuneration.

(4) Policy for deciding the balance of types of remuneration

The ratio of different types of Board Member remuneration will consider for reference the remuneration standard of companies that have a similar business scale or reside in the same business type as our company, and will be structured so the higher the position the greater the correlation with company performance and corporate value, and will be studied by the Nomination and Remuneration Committee. The Board Meeting will respect the content of the report from the Nomination and Remuneration Committee, and should decide on the ratio of types of remuneration that is in that report.

(5) Items relating to individual Board members' remuneration content

Based on the decision of the Board Meeting, individual remuneration amounts are entrusted to the Representative Director Chairman and CEO, and the content of that authority is to decide the amount of management remuneration of each Board Member and the amount of variable remuneration of each Board Member taking performance evaluation into account. To ensure that the Representative Director Chairman and CEO exercises that authority appropriately, the Board Meeting will put the proposal from the Representative Director Chairman and CEO to the Nomination and Remuneration Committee, and the Representative Director Chairman and CEO must the decide based on its report.

Internal Compliance

Based on TPR's Corporate Philosophy, "Basic Policy Regarding the Internal Compliance System" is established, and as well as ensuring that work is appropriate, it will build a more efficient internal compliance system, aiming for continuous improvement.

Also, our company is proactively engaged with internal compliance reporting schemes (commonly called J-SOX law) relating to financial reports as required by the Financial Instruments and Exchange Law, and deal with this appropriately and properly with the advice of specialists.